Welcome to the wild world of Foreclosure and bankruptcy, where financial dreams can go to die and be resurrected like a financial phoenix! You might think of it as a sad tale of lost homes and dwindling bank accounts, but fear not! We’re here to navigate through the maze of paperwork and legal jargon, shedding light on how to dodge the financial Grim Reaper and maybe even laugh along the way.

In this guide, we’ll unravel the foreclosure process, dissect bankruptcy options, and slap together some snazzy financial recovery strategies that’ll make your future shine brighter than your grandma’s prized silverware. From understanding the nitty-gritty of credit scores and foreclosure types to mastering that post-bankruptcy budgeting plan, we’ve got everything you need right here!

Foreclosure Process and Implications

The foreclosure process can feel like a rollercoaster ride, but not the fun kind with cotton candy and thrill-seeking glee. Instead, it’s more like that awkward ride where you regret your decisions halfway through. Understanding this process is crucial to navigate the financial labyrinth and come out the other side with your sanity intact and your credit score not looking like a disaster zone.The foreclosure process typically unfolds in a series of steps that can seem daunting and perplexing, much like assembling IKEA furniture without instructions.

Here’s a closer look at the process and its implications for your financial well-being.

Steps in the Foreclosure Process

Foreclosure isn’t an overnight affair; it’s a slow dance that can last several months. Understanding the sequence of events is essential for anyone facing the music. Here’s how it generally goes down:

- Missed Payments: It all starts innocently enough with a missed mortgage payment. One month leads to two, and suddenly your lender is sending you love letters that are anything but affectionate.

- Default Notice: After three to six months of missed payments, you’ll get a default notice. Think of this as the mortgage equivalent of your mom saying, “We need to talk.”

- Foreclosure Filing: If things don’t improve, the lender will file a foreclosure suit. This is where the real legal drama begins, complete with court appearances and legal jargon that sounds like a foreign language.

- Court Hearing or Auction: Depending on your state, you may face a court hearing (judicial foreclosure) or a public auction (non-judicial foreclosure). It’s like being on trial for a crime you didn’t commit—your mortgage payment.

- Eviction: If the situation escalates to the point of no return, an eviction notice may follow. At this point, you might want to pack your bags and find a cozy corner in your friend’s basement.

Impact of Foreclosure on Personal Credit Scores

Foreclosure doesn’t just slam the door on your house; it also takes a sledgehammer to your credit score. The impact is severe and long-lasting, much like that one embarrassing photo from college that keeps resurfacing at family gatherings. Here’s how it breaks down:

- Initial Score Drop: Expect an immediate drop of anywhere from 100 to 200 points on your credit score. Ouch! That’s like getting slapped in the face with reality.

- Long-term Effects: A foreclosure can linger on your credit report for up to seven years. It’s the unwanted guest that just wouldn’t leave, haunting your financial history.

- Future Credit Challenges: Securing new loans or credit can become as tricky as finding a parking spot in a busy city. Lenders will see the foreclosure and may hesitate to offer you credit, fearing you might lead them down the same dark path.

Judicial vs. Non-Judicial Foreclosure Processes

When it comes to foreclosure, the method can vary based on where you live, and it’s essential to know the difference between judicial and non-judicial processes. Each has its quirks, like comparing cats to dogs—similar yet completely different in behavior.

- Judicial Foreclosure: This process involves the court system, where the lender must file a lawsuit to initiate foreclosure. It’s akin to a dramatic courtroom scene in a movie, complete with legal wrangling.

- Non-Judicial Foreclosure: This method bypasses the court system entirely, allowing lenders to foreclose on properties through a series of out-of-court steps. It’s like a quickie divorce—fast and, well, emotionally taxing.

- Timeframe Differences: Judicial foreclosures can take a long time to resolve, sometimes spanning years. Non-judicial foreclosures are typically quicker, meaning you might be packing your bags sooner than you’d like.

Bankruptcy Options and Processes

When life throws financial curveballs, sometimes you just have to throw your hands up and say, “I’m bankrupt!” But fret not, because bankruptcy isn’t the end of the world—it’s more like a cringe-worthy plot twist in your financial drama. In this segment, we’ll explore the various bankruptcy options available and what it takes to file for them. Spoiler alert: it’s more than just a dramatic sigh and a pile of bills.Different types of bankruptcy exist for both individuals and businesses, and understanding these options can help you navigate the rough waters of financial distress.

Below, we detail the most common types of bankruptcy, along with the requirements and documentation needed to dive in.

Types of Bankruptcy

Navigating the world of bankruptcy can feel like trying to find your way through a corn maze at midnight. But fear not! Here’s a handy guide to the types of bankruptcy you might encounter, each with its own unique flavor.

- Chapter 7 Bankruptcy: This is the “liquidation” type, where eligible debtors can wipe out most of their unsecured debts and get a fresh start. It’s like spring cleaning, but for your finances!

- Chapter 11 Bankruptcy: Mainly for businesses, this type allows them to reorganize their debts while keeping operations running. It’s the corporate equivalent of putting on a superhero cape and saying, “I can still save the day!”

- Chapter 13 Bankruptcy: This option is for individuals who have a regular income and want to create a repayment plan to pay back their debts over time. Think of it as a long-term subscription service for your financial obligations.

Requirements and Documentation

Now that you know the types of bankruptcy, let’s talk about what you need to actually file. Spoiler: it involves paperwork—a lot of it! Here’s a list of the typical requirements and documentation needed, so you can prepare like a pro.

- Credit Counseling Certificate: Before filing, you must complete a credit counseling course and obtain a certificate. It’s the warm-up before your financial marathon!

- Income Documentation: This includes pay stubs, tax returns, and any other evidence of income. Basically, you need to prove you’re not hiding a treasure chest of gold somewhere.

- List of Debts: You’ll need to compile a comprehensive list of debts, including amounts and creditor information. Think of it as writing a love letter to all the people you owe money to—very heartfelt!

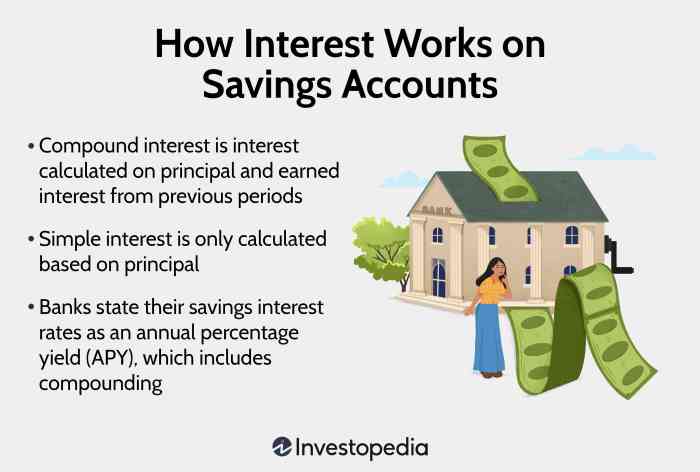

- Asset Documentation: Details about your assets, including property and bank accounts, must be disclosed. Because hiding things from the court is like trying to hide a hippo in your closet—impossible!

Average Timeline and Costs

Filing for bankruptcy isn’t a quick jaunt to the beach; it’s more of a marathon through paperwork and court dates. Here’s what you can expect regarding timelines and costs, so you can plan accordingly and maybe even have a snack or two along the way.

- Timeline: The average timeline for a Chapter 7 bankruptcy is approximately 3 to 6 months, while Chapter 13 can take 3 to 5 years due to the repayment plan. Patience is key here—maybe take up knitting?

- Costs: Filing fees range from $310 for Chapter 13 to $335 for Chapter 11, plus attorney fees that can vary widely. Budgeting for these costs is essential, lest you find yourself back in the bankruptcy cycle faster than you can say, “I’ll never financially recover from this!”

“Bankruptcy is not a failure; it’s a chance to start anew.”

Financial Recovery Strategies

Recovering from foreclosure or bankruptcy can feel like trying to find a needle in a haystack while blindfolded. Yet, fear not! With a sprinkle of financial wisdom and a dash of humility, you can navigate the rough waters of financial recovery like a seasoned sailor. This guide offers actionable strategies to help you regain your financial footing, rebuild your credit, and even demystify the loans that could aid your recovery.

Comprehensive Budgeting Plan Post-Foreclosure or Bankruptcy

Creating a comprehensive budgeting plan is akin to drawing a treasure map to your financial recovery. A solid budget leads you through the maze of expenses and income, ensuring you don’t end up lost in a financial wilderness. To embark on this budgeting adventure, consider the following essential steps:

- Track Your Income: Start by writing down all sources of income. This includes your salary, side hustles, and any passive income streams (yes, those exist!).

- List Your Expenses: Next, jot down all monthly expenses. Don’t forget the sneaky ones like subscriptions and that occasional impulse buy of artisanal avocado toast.

- Prioritize Needs Over Wants: Separate your needs (like food and shelter) from your wants (like that new gaming console). Allocate funds accordingly to avoid overspending.

- Establish an Emergency Fund: Try to squirrel away a little something each month for emergencies. Think of it as your financial safety net, catching you when life throws curveballs.

- Review and Adjust Regularly: A budget isn’t a one-and-done deal; it needs regular check-ups. Review it monthly to make adjustments as needed—just like a car requires oil changes.

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

Tips for Rebuilding Credit After Foreclosure or Bankruptcy

Rebuilding credit post-financial hiccups might feel like trying to climb Mount Everest in flip-flops, but with the right gear, it’s totally achievable. Your credit score is a crucial part of your financial health and can influence your ability to secure loans down the road. Here are some fabulous pointers to get you back on track:

- Check Your Credit Report: Obtain your credit report and review it for errors. Dispute any inaccuracies because your credit score shouldn’t be blemished by someone else’s mistakes.

- Pay Bills on Time: Establish a history of timely payments. Consider automating payments to avoid the risk of a missed due date—your future self will thank you.

- Consider a Secured Credit Card: Using a secured credit card responsibly can help rebuild your credit. Just remember, it’s not a license for a shopping spree!

- Limit New Credit Applications: Each time you apply for new credit, your score takes a slight hit. Be strategic and only apply when necessary.

- Keep Old Accounts Open: Length of credit history matters. Keeping older accounts open (even if you don’t use them) can positively impact your score.

“The only way to improve your credit score is to pay your bills, reduce your debt, and keep your spending in check.”

Comparison of Commercial Loans and Personal Loans in the Context of Financial Recovery

When it comes to financing your recovery, understanding the difference between commercial loans and personal loans is paramount. Each has its own set of characteristics, benefits, and pitfalls, like a choose-your-own-adventure book where the path you take can significantly alter your financial future.

| Aspect | Commercial Loans | Personal Loans |

|---|---|---|

| Purpose | Intended for business needs, such as expansion or equipment purchases. | Used for personal expenses like debt consolidation or major purchases. |

| Collateral | Often requires collateral (assets) to secure the loan. | Usually unsecured; relies on creditworthiness. |

| Loan Amount | Tends to be larger amounts compared to personal loans. | Typically smaller amounts, suitable for individual needs. |

| Interest Rates | Interest rates can vary widely based on business risk factors. | Generally lower interest rates for those with good credit. |

| Application Process | Can be more complex with extensive documentation required. | Typically simpler and faster application process. |

With a clear understanding of your options, you are now equipped to make informed decisions that can aid your financial recovery journey. Remember, every small step can lead to big changes, so keep your eyes on the prize and let your financial phoenix rise from the ashes!

Last Recap

And there you have it! With newfound knowledge about Foreclosure and bankruptcy, you’re now armed to the teeth (well, metaphorically) to tackle these financial challenges head-on. Whether you’re in the midst of a crisis or planning your financial future, remember that a good strategy can turn even the bleakest of situations into a springboard for success. So go forth, conquer those credit scores, and may your financial journey be as smooth as a freshly paved road!

Q&A

What is the first step in the foreclosure process?

The first step typically involves a missed mortgage payment, which sets off a chain of notifications and legal actions by the lender.

How long does bankruptcy stay on your credit report?

Bankruptcy can stay on your credit report for up to 10 years, but the pain fades over time if you rebuild your credit wisely!

Can I keep my house if I file for bankruptcy?

It depends on the type of bankruptcy you file and your state laws, but many folks can keep their homes with the right strategies.

What’s the difference between Chapter 7 and Chapter 13 bankruptcy?

Chapter 7 wipes out most debts quickly but may require selling assets, while Chapter 13 is a repayment plan that allows you to keep your assets while paying off debts over time.

Is foreclosure the same as bankruptcy?

Nope! Foreclosure is the process of losing your home due to unpaid mortgage, while bankruptcy is a legal way to manage or eliminate debt.